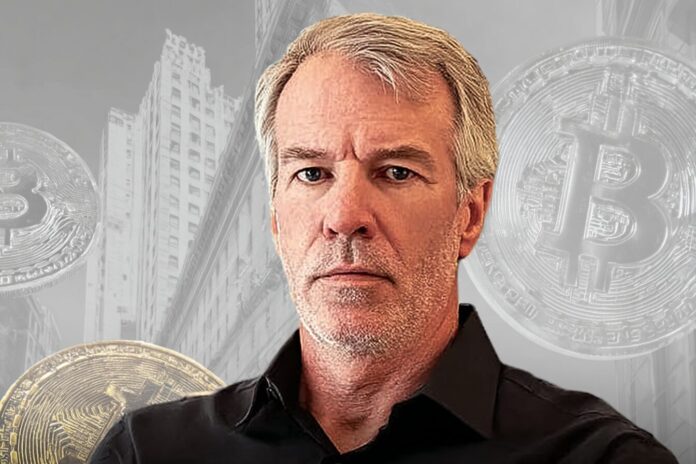

Michael Saylor, the celebrated Executive Chairman of MicroStrategy, is once again pushing the boundaries of digital asset adoption. His visionary approach has now taken a decisive step forward by partnering with NYDIG to introduce a pioneering investment product. This unique vehicle combines the familiar stability of traditional money-market funds with the dynamic, performance-driven characteristics of Bitcoin.

Because this new initiative is built on solid regulatory frameworks and proven digital asset strategies, it promises to redefine how institutional investors access the benefits of Bitcoin. Most importantly, it connects Wall Street’s rigorous standards with innovative crypto solutions, a fusion that is set to attract significant corporate and institutional attention.

The Product: Bitcoin-Backed Cash Alternatives

NYDIG’s new offering does not grant direct Bitcoin exposure; rather, it leverages Bitcoin’s established return history to back a money-market-style vehicle. Therefore, investors can enjoy the benefits of consistent, high yields, utilizing traditional cash management methods without the complexities of holding and safeguarding the digital asset directly. This approach offers a stable risk-return profile enhanced by Bitcoin’s performance history, as detailed in recent reports by CoinDesk.

Besides that, the innovative structure bridges the gap between conventional finance and digital asset innovation. Because of its design, the product caters particularly well to institutions seeking regulated investment vehicles that incorporate modern technology while maintaining traditional safeguards. This dual-purpose model is an exciting development for both risk-averse investors and those seeking dynamic returns, as highlighted by insights on sites like Fidelity Digital Assets and ONEsafe.

Why This Vehicle Matters Now

This investment vehicle arrives at a pivotal moment when institutional appetite for alternative assets is growing. Most importantly, it aims to unlock a new pool of capital by providing corporations, treasurers, and institutional investors access to a product that blends regulated stability with the high-return potential of Bitcoin. Therefore, companies restricted by regulatory regimes can now tap into Bitcoin’s upward trajectory in a measured and compliant manner.

In addition, the product addresses the need for yield generation amid uncertain economic conditions. Because traditional cash instruments offer limited returns, institutions are exploring innovative solutions that meld modern asset classes with time-tested money-market strategies. Inspired by evolving trends in digital asset management, this initiative is positioned as a solution for diversified portfolio construction and liquidity management.

How It Works: Structure and Safeguards

The structure of this product is built upon using Bitcoin as collateral rather than direct exposure. This ingenious design mitigates volatility while preserving the asset’s ability to generate yield. Because risk is managed through sophisticated controls, the investment remains compliant with existing custody and regulatory frameworks. Oversight by established market participants such as NYDIG further ensures institutional-grade reporting and transparency.

Moreover, this carefully engineered mechanism offers significant peace of mind to conservative investors. Most importantly, the product employs layered risk controls that actively monitor Bitcoin’s market behavior. As noted by NYDIG and industry experts referenced in CoinDesk, these safeguards are crucial in blending the energetic nature of digital assets with the stability expected by traditional money-market funds.

MicroStrategy’s Strategic Perspective

Saylor’s approach has always been about transforming speculative assets into tools for corporate balance sheets. Over the past five years, his leadership has seen MicroStrategy accumulate Bitcoin worth billions, thereby revolutionizing the concept of a corporate treasury reserve. Most importantly, this strategy demonstrates that Bitcoin can serve not only as a store of value but also as a vehicle for institutional innovation.

Because Saylor’s previous initiatives have consistently set new industry standards, this money-market-style fund is a natural progression in the journey toward mainstream crypto adoption. Therefore, it acts as a beacon for other executive leaders by showcasing how bold digital asset strategies can coexist with the stringent requirements of corporate finance, as also explored by ONEsafe and Fidelity Digital Assets.

Risk, Return, and The Institutional Case for Bitcoin

Historically, money-market funds have been synonymous with safety and liquidity, yet they offer limited yield potential. With the integration of Bitcoin’s robust performance record, this financial instrument opens the door to accessing substantially higher returns. Most importantly, it provides a novel solution for investors who need to patrol inflation and uncertain monetary policies while still valuing capital preservation.

Because this innovative product is designed specifically for institutional investors, it minimizes the typical operational complexities associated with direct digital asset management. In doing so, it builds a persuasive case for incorporating Bitcoin into traditional portfolios, thus blurring the lines between conventional yield strategies and modern, blockchain-driven returns.

The Bigger Picture: Digital Asset Convergence on Wall Street

The introduction of this product underscores a broader trend: the convergence of digital assets and established financial markets. Because institutions are now recognizing Bitcoin’s potential beyond mere speculation, products like this represent a paradigm shift. Most importantly, the growing acceptance of Bitcoin as a foundational asset class paves the way for further integration across financial products, including spot Bitcoin ETFs and digital lending platforms.

Furthermore, the current market environment—with its blend of volatile inflation and evolving central bank policies—necessitates alternative investment strategies. As noted by NYDIG and fidelity research, traditional financial institutions are increasingly seeking solutions that combine the best of both worlds. This product therefore acts as a bridge, connecting the stability of conventional money management with the transformative potential of blockchain technology.

What’s Next?

Saylor’s unwavering conviction in digital asset innovation, combined with NYDIG’s established Wall Street presence, sets the stage for additional breakthroughs in institutional finance. Most importantly, the success of this vehicle may catalyze the development of new fixed-income products tied to digital assets. Therefore, the landscape of institutional portfolio construction is poised for dramatic evolution.

Because financial innovation rarely stands still, expect a surge in hybrid traditional-digital frameworks designed to meet the needs of modern investors. As the industry experiments with various risk management protocols and product structures, this initiative will likely be seen as a crucial milestone in the journey toward mainstream digital asset acceptance.

Further Reading and References

For more detailed insights, visit the following sources and deepen your understanding of this breakthrough: Michael Saylor Is Bringing Bitcoin-Backed Money-Market-Style Vehicle to Wall Street: NYDIG (CoinDesk).

Explore further commentary on Saylor’s innovative tactics at The Tremor of Michael Saylor’s Bold Bitcoin Tactics (ONEsafe) and gain insight into corporate treasury developments via Adding Bitcoin to a Corporate Treasury (Fidelity Digital Assets).