LayerZero (ZRO) has once again proven its market resilience and adaptability. In a scenario that many did not expect, the token rebounded by 1.12% after significant selling pressure caused by a major token unlock event. This rapid recovery has intrigued investors and crypto enthusiasts alike, fueling discussions about ZRO’s underlying strength and long-term potential. Most importantly, this recovery reflects the project’s strong fundamentals and dynamic market behavior.Because market shifts often create opportunities for savvy traders, this rebound has sparked renewed optimism regarding ZRO’s performance. Besides that, the project’s robust roadmap and strategic partnerships are key factors that enabled it to withstand adverse market conditions, setting the stage for further growth in 2025 and beyond.

The Recent ZRO Token Unlock: What Happened?

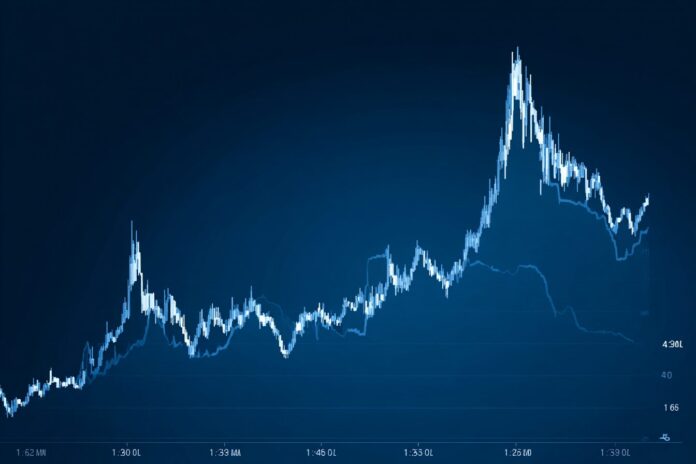

On July 20, 2025, LayerZero executed a scheduled token unlock which released 25.71 million ZRO tokens into the market. This event increased the circulating supply by approximately 23%, leading to immediate selling pressure as token holders rushed to adjust to the sudden change in market dynamics. Consequently, the price dropped sharply by 2.75% during the initial phase of the unlock, momentarily setting the price to $2.26.Because such unlock events are typically accompanied by heightened market volatility, many traders anticipated a rapid shift. However, as seen on platforms like Blockchain.News, the initial sell-off was followed by stabilization efforts that helped the token bounce back. Therefore, even short-term disruptions may pave the way for long-term gains when supported by a robust market structure.

Price Rebound Amid Neutral Market Signals

In an impressive show of strength, LayerZero rebounded to $1.98 – a notable increase of 1.12% over a 24-hour period. This rebound occurred despite a generally neutral technical outlook indicated by an RSI of approximately 44.89. Because the RSI levels hover near the middle range, analysts believe that the market could swing in either direction in the short term, which makes this recovery all the more significant.Moreover, immediate support levels have been identified at $1.74, offering a cushion for risk-averse investors. Most importantly, this recovery is an encouraging sign that market forces and investor sentiment can override even significant sell-offs, as reported on Blockchain.News. Because technical indicators appear balanced, investors remain cautiously optimistic about ZRO’s near-term prospects.

Key Drivers Behind ZRO’s Resilience

Mere selling pressure rarely determines the long-term trajectory of a fundamentally strong project, and LayerZero is no exception. Because of its foundational technology and strategic outlook, several key factors have helped ZRO maintain stability during volatile periods. Most importantly, its strong network effects, established through robust partnerships and institutional support, continue to underpin its market strength.For example, on July 24, 2025, LayerZero announced a strategic partnership with Muon to enhance cross-chain interoperability. This pivotal collaboration is expected to drive secure token transfers among decentralized applications (dApps) and support the launch of a multichain token launchpad. Besides that, the fact that the project holds an 80% market share in cross-chain messaging protocols, as noted in community discussions, reinforces its position as a market leader. In addition, a significant $55M investment from VC firm a16z provided not only financial backing but also boosted investor confidence, as detailed on platforms like Bybit and Bitget.

LayerZero (ZRO) Price Outlook: 2025 Scenarios

Analysts are optimistic about ZRO’s future, suggesting that the token will stabilize and potentially experience modest growth as the market digests the unlock event. Therefore, recent price predictions indicate that ZRO may trade at around $2.02 shortly, followed by incremental gains reaching approximately $2.03 over the next month. This projection implies a favorable annualized growth rate of about 5% for 2025, which is encouraging for both current holders and new investors.Because cryptocurrency markets are influenced by broader economic factors and the evolving DeFi ecosystem, near-term movements may mirror global crypto market sentiment. Moreover, increased integration of LayerZero into multichain and cross-chain protocols is expected to provide sustained upward momentum, as discussed on sites like MEXC. Most importantly, this potential for growth reinforces the token’s appeal amidst dynamic market conditions.

What Investors Should Consider

Investors should note that while token unlock events can introduce short-term volatility, they often present long-term opportunities. Because historical trends suggest that such events seldom compromise the underlying value of a project, thorough research is crucial before making decisions. Most importantly, understanding that LayerZero’s strong utility in DeFi and cross-chain communications offsets temporary price dips can help investors remain confident in their positions.Furthermore, employing sound risk management strategies—such as monitoring key technical indicators, setting stop-loss levels, and staying informed about token schedules—is advisable. Because strategic patience and diligence are rewarded in volatile environments, investors are encouraged to follow industry news and expert analyses, as highlighted on platforms like Blockchain.News and Bybit.

Conclusion: Resilience in the Face of Supply Shocks

LayerZero’s recent ability to rebound 1.12% in the wake of a significant token unlock demonstrates not only the project’s inherent strength but also its robust market infrastructure. Besides that, its strategic partnerships, like the recent alliance with Muon, complement its technical advancements and drive adoption across DeFi applications. Because these factors work together harmoniously, the long-term investment case for ZRO appears promising.Therefore, while short-term fluctuations are inevitable in any dynamic crypto market, maintaining a long-term focus is key. Most importantly, as the LayerZero ecosystem expands and integrates deeper into cross-chain communications, investors should remain attentive to on-chain developments and market signals. This approach will help them capitalize on future growth opportunities while managing inherent risks, as further explained in detailed price predictions on Bitget.

References

- Blockchain.News: LayerZero (ZRO) Rebounds 1.12% Despite Major Token Unlock Selling Pressure

- Blockchain.News: LayerZero (ZRO) Price Drops 2.6% as Token Unlock Pressure Outweighs a16z Investment

- MEXC: LayerZero (ZRO) Price Prediction & Price Forecasts 2025

- Bybit: LayerZero Price: ZRO Live Price Today | Market Cap & Chart Analysis

- Bitget: LayerZero (ZRO) Price Prediction