Bitcoin in August 2025: Where Does the Market Stand?

Bitcoin continues to capture the spotlight in the global financial landscape. As of August 5, 2025, Bitcoin is hovering near $114,446, after recently rebounding from lows beneath $112,000. However, upward movement has been contained, and traders are monitoring resistance around $116,000. This narrow range reflects a phase of market uncertainty, fueled by mixed technical signals and subdued trading activity. Most importantly, market participants are taking cautious steps amid a blend of bullish and bearish indicators.

Because the market remains in a state of equilibrium, technical analysis combined with historical cycle insights become crucial. Aside from price levels, traders are also looking into volume trends and derivative activity to gauge the underlying sentiment. Furthermore, recent reports indicate that Bitcoin may soon break out of its current consolidation phase, as detailed in recent insights from CryptoRank.

Key Technical Insights and Trading Patterns

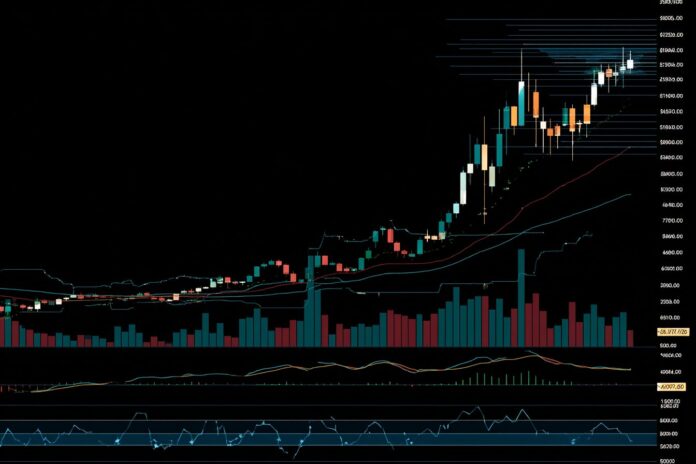

Most importantly, technical indicators suggest Bitcoin is in a critical compression zone. The 4-hour chart reveals that BTC is tightly bound below a persistent descending trendline, with critical resistance at $116,200 and support at approximately $112,500. Besides that, the Relative Strength Index (RSI) currently sits at 48, signaling a potential neutral trend, while the MACD indicates that buying power is stalling. Therefore, traders are eagerly anticipating a decisive breakout.

Because the market is teetering on the edge of a significant move, many investors have begun to scrutinize Bollinger Bands that show tight compression. Besides, funding rates remain neutral and derivatives volumes are declining, which supports the notion of cautious investor sentiment. In addition, evaluating these technical cues with updated market cycles from Caleb & Brown helps provide a broader context for Bitcoin’s behavior in the current cycle.

Short-Term Forecasts and Price Projections

Recent forecasts suggest that Bitcoin may experience gradual price increases, potentially climbing to around $116,716 by August 5, 2025. However, there is also a possibility of a temporary dip to lows approximating $109,224. Because of these conflicting projections, investors are advised to remain vigilant and flexible in their strategies. Therefore, market participants must prepare for sudden shifts in price dynamics.

Moreover, as the market moves into autumn, there is notable volatility with possible price ranges for October 2025 predicted to vary between $106,758 and $117,162. Most importantly, such fluctuations emphasize the need for active portfolio management and staying updated with key market indicators, as further elaborated by Changelly Blog.

Understanding Bitcoin’s Current Cycle and Historical Trends

Bitcoin’s market behavior is inherently cyclical, moving through distinct phases such as accumulation, growth, bubble, and crash. At this point, Bitcoin appears to be in a late-growth or pre-correction phase. Because of its strong rally earlier in the year, the market is now digesting recent gains, leading to sideways action and diminished speculative fervor. Consequently, this consolidation can be viewed as a precursor to either significant upward breakout or an imminent correction.

Moreover, historical data supports this pattern, as prolonged range-bound trading often sets the stage for eventual volatility. Therefore, understanding these cycles is essential for making informed investment decisions. In addition, academic research, like that discussed in publications available on Springer, provides additional depth on crypto market dynamics and economic theories behind asset cycles.

State of the Wider Crypto Market

Besides Bitcoin, the broader crypto market remains closely correlated with BTC’s price movements. Because Bitcoin dominates the market in both sentiment and capital allocation, any fluctuations in its price tend to affect other cryptocurrencies. Most importantly, this interconnectedness means that when Bitcoin consolidates or experiences volatility, the cascading effect is seen across various digital assets. Traders and investors should be aware of this dynamic as they diversify their portfolios.

Furthermore, trading volumes on major exchanges continue to decline, suggesting a cautious wait-and-see approach by investors. As derivatives volumes flatten and open interest remains subdued, market participants are carefully watching for emerging trends. Therefore, these factors collectively underscore a period of indecision which can influence market strategies. Detailed studies on market correlations can be found on CryptoRank and other analysis platforms.

Investor Psychology and Market Sentiment

Investor sentiment plays a crucial role in shaping short-term market movements. Because traders often react swiftly to news and macroeconomic shifts, understanding the psychological aspects behind market actions is essential. Most importantly, when market conditions are range-bound, any positive or negative headline can quickly alter sentiment, as illustrated by the frequent shifts witnessed in Bitcoin’s Fear & Greed Index.

Besides technical measures, investors increasingly rely on behavioral analysis to navigate these unpredictable markets. Because sentiment indicators tend to return to neutrality during periods of calm, active monitoring of news, regulatory changes, and macroeconomic trends is indispensable. Therefore, in-depth coverage from experts, such as provided by Caleb & Brown and analysis from CoinDesk, helps demystify these patterns.

What’s Next for Bitcoin and Cryptocurrencies?

Looking ahead, market watchers anticipate increased volatility as Bitcoin approaches major resistance and support levels. Because upcoming halving events, further regulatory clarity, and expanding institutional participation could act as catalysts, investors should prepare for rapid market shifts. Most importantly, adapting to these changes with a flexible strategy will be vital for navigating uncertain times.

In addition, market sentiment may undergo substantial changes as macroeconomic conditions evolve. Therefore, maintaining an updated understanding of both global economic trends and micro-level crypto market indicators is critical. As noted in several comprehensive analyses, such as the findings from Changelly Blog, keeping abreast of these developments is crucial for long-term investment success.

Conclusion: Staying Agile in the Crypto Market

In summary, Bitcoin and the broader crypto market are currently in a transitional phase characterized by compressed price action and fluctuating investor sentiment. Because technical levels, market cycles, and external economic factors all interplay, a nuanced understanding of these elements is necessary for successful trading. Most importantly, investors should continue to monitor technical breakout signals and fiscal policy changes to best position themselves in the market.

Therefore, staying agile and responsive to new market data is essential in today’s dynamic environment. As such, leveraging insights from reputable sources like CryptoRank, Caleb & Brown, and Changelly Blog will empower investors to navigate the challenges ahead.

References

- Bitcoin (BTC) Price Prediction for August 5, 2025 – CryptoRank

- Bitcoin’s Market Cycle & Crypto Cycles Chart – Caleb & Brown

- Bitcoin (BTC) Price Prediction 2025-2030 – Changelly Blog

- Cryptocurrencies: Market Analysis and Perspectives – Springer

- Bitcoin Still on Track for USD140K This Year, But 2026 Will Be Painful – CoinDesk